As with most cards, the late payment fees, at up to $39, is where you’ll get hit the hardest. While the card’s fees may be higher than average, they’re manageable, with an 8% ($5 minimum) fee for cash advances and 3% ($1 minimum) for foreign transaction fees. And if you are building or repairing poor credit history, you already know that the no-fee cards won’t be rolling your way.įor now, make do with what you can. Average fees and penaltiesĬredit card fees and penalties are the price of admission to the wonderful world of credit, especially when you’re just starting out. Plus, if you pay off your balance in full each month, that high APR will never affect you. While some may balk at such a high interest rate, it may be better to just consider the APR a deterrent for irresponsible behavior, such as overspending or making late payments. Beware of the high APRīecause this card is targeted toward customers with less-than-stellar credit, the Credit One Bank Platinum Visa card can get away with charging a higher variable APR: 28.74%. When factoring in the annual fee (up to $39) and average cash back rewards earned ($17), you’re looking at a yearly cost of $22, which is considered “very good,” especially for cardholders with more limited options. By our estimates, the average cardholder charges approximately $3,600 per year on their Cash Back Rewards card. For a starter card, it offers a pretty good value. Low cost of ownershipĬredit isn’t free, and neither is the Credit One Bank Platinum Visa card. Not a bad deal if you remember to shop at the right places.

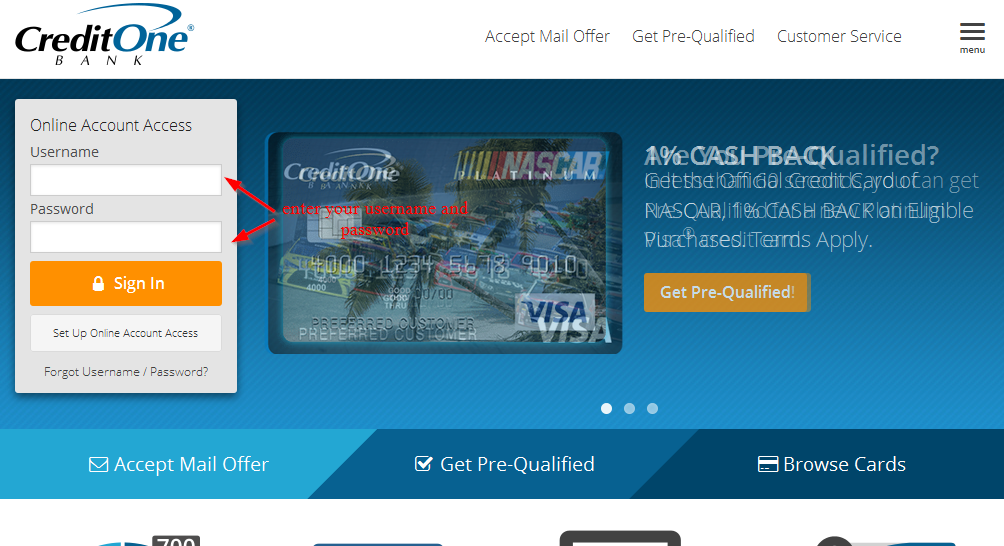

And the best part? There’s no annual limit on what you can earn.įor more benefits, the Credit One Bank Platinum Visa card offers 10% more cash back rewards from participating top retailers. Since for many, these are recurring purchases, there are plenty of opportunities to earn cash back rewards. Cardholders can earn 1% cash back on all eligible purchases, which include gas, groceries, mobile phone, internet, cable and TV. Better-than-average rewards programįor a starter card, the Credit One Bank Platinum Visa card offers a decent rewards program, though there are better ones around. Also, keep in mind that timely payments and good performance will lead to regular credit increases. While it might seem low, this is smart for people who are learning or relearning good credit habits. As such, most customers begin with a low credit limit of around $300. This card is targeted toward customers with fair to average credit, who may not have the wide range of choices offered to those with higher credit scores. While this card doesn’t offer all the bells and whistles as comparable cards, it still boasts a solid rewards program, as well as many other perks.

The Credit One Bank Platinum Visa is a practical choice especially for people just starting their credit-building journey or who need to repair past credit.

0 kommentar(er)

0 kommentar(er)